2023年最佳UNI币钱包推荐:安全、便捷、用户体验

在加密货币市场中,UNI币作为Uniswap的代币,近年来受到了越来越多投资者的关注。随着数字资产的快速增长,选择合适的钱包变得至关重要。本文将全面解析2023年最佳UNI币钱包,为您的数字资产保驾护航。

一、理解UNI币及其应用

UNI币是去中心化交易平台Uniswap的治理代币。作为一种自动化做市商(AMM)平台,Uniswap允许用户在以太坊区块链上进行代币交换,而UNI币则赋予持有者对平台的治理权,参与决策。UNI币的价值不仅在于它的交易功能,还在于其在DeFi生态系统中的重要角色。因此,安全地存储和管理UNI币显得尤为重要。

二、选择UNI币钱包的因素

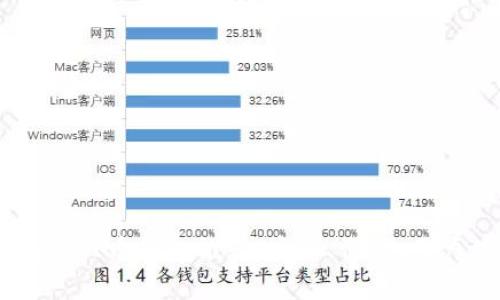

选择一个合适的UNI币钱包时,需要考虑多个因素。例如,安全性、易用性、兼容性、支持的功能等等。无论是硬件钱包、软件钱包还是在线钱包,各自都有优劣势。通常,硬件钱包被认为是最安全的选择,但也相对笨重;而软件钱包则提供了更好的用户体验,方便日常使用。

三、2023年最佳UNI币钱包推荐

根据功能、用户体验和安全性,以下是目前最受欢迎的UNI币钱包推荐:

1. Ledger Nano X(硬件钱包)

Ledger Nano X 是目前市场上最受欢迎的硬件钱包之一。它支持2500多种加密货币,具备高水平的安全性。通过蓝牙功能,用户可以方便地连接手机,随时随地管理资产。此外,Ledger Live应用程序提供了流畅的用户体验,适合各种经验水平的用户。

2. MetaMask(软件钱包)

MetaMask 是一个广泛使用的以太坊钱包,它支持各种ERC20代币,包括UNI币。MetaMask 可以作为Chrome或Firefox的扩展程序,也可以作为移动应用,便于用户轻松访问DeFi服务及去中心化应用(DApps)。它直接与各种DeFi项目集成,为用户提供便捷的操作体验。

3. Trust Wallet(移动钱包)

Trust Wallet 是一款由Binance支持的数字资产钱包,拥有友好的用户界面。它支持多种加密货币和代币,包括UNI币。Trust Wallet 还具备内置的DApp浏览器,允许用户轻松访问不同的去中心化交易所和DeFi平台。

4. Exodus(桌面钱包)

Exodus 是一款非常受欢迎的桌面钱包,支持大多数主要加密货币,用户界面友好。它提供不断更新的市场数据,方便用户了解资产状况。同时,Exodus 还支持硬件钱包集成,增加了安全性。

四、如何安全存储和管理UNI币

安全是存储数字资产的首要考虑因素。以下是一些安全存储和管理UNI币的建议:

- 选择先使用硬件钱包进行长期存储,并将大部分币种存放在硬件钱包中。

- 在使用软件和移动钱包时,确保启用双重身份验证(2FA)。

- 定期更新钱包软件,确保使用最新的安全功能。

- 备份钱包助记词和私钥,绝对不能泄露给任何人。

五、相关问题解答

1. UNI币和其他加密货币相比有什么特别之处?

Reflecting on what sets UNI tokens apart from other cryptocurrencies, we find that their primary uniqueness lies in their decentralized governance model. Holders of UNI gain voting rights that influence the protocol's future decisions, including fee structures, new features, and network upgrades. This degree of involvement fosters a sense of ownership among users, promoting a community-driven approach that is less common in other cryptocurrencies.

Another distinguishing characteristic is the integration of UNI into emerging decentralized finance (DeFi) ecosystems. By bridging liquidity pools and allowing users to trade different tokens effortlessly, UNI plays a crucial role in providing liquidity while simultaneously contributing to the platform’s sustainability. Moreover, the tokenomics surrounding UNI, including rewards for liquidity providers and governance participation, amplify its utility and appeal in the ever-growing DeFi landscape.

2. 如何选择合适的钱包根据投资策略?

Choosing the right wallet according to investment strategy is crucial for managing and safeguarding assets effectively. For long-term investors who prioritize security, hardware wallets like Ledger Nano X are recommended due to their offline storage capabilities minimizing exposure to potential hacks.

Conversely, active traders, who require frequent access to funds, may benefit from software wallets such as MetaMask or Trust Wallet. The convenient user interfaces of these wallets allow traders to execute transactions quickly and respond to market movements in real-time. Additionally, one should consider wallets with built-in exchange features, facilitating easier trading without the necessity of moving funds between various platforms.

Risk tolerance is another critical factor. Those comfortable with the risks associated with online wallets may opt for custodial services that offer ease of use and additional features, while risk-averse users might lean towards cold storage options. Always understand personal investment styles, anticipated usage frequency, and appetite for risk to select a suitable wallet.

3. UNI币的未来前景如何?

The future of UNI and its role within the broader DeFi ecosystem presents exciting possibilities. As decentralized finance continues to flourish, the demand for UNI may increase in tandem due to its governance capabilities and integral part it plays in liquidity provision. Moreover, ongoing developments in the DeFi ecosystem that leverage UNI for innovative financial products, integrated trading features, and governance enhancements can further solidify its market position.

Furthermore, as more retail and institutional investors flock to DeFi solutions, UNI's adoption rate may rise. The transition of traditional financial systems towards blockchain-enabled counterparts can propel the use of tokens like UNI in everyday transactions, trading, and investment. However, the uncertainty surrounding regulatory perspectives on DeFi and token standards could influence its trajectory, necessitating active monitoring of legal frameworks and market sentiments in the coming years.

4. UNI币存储时常见的安全漏洞有哪些?

When managing assets like UNI tokens, being aware of common security vulnerabilities can provide foresight in avoiding potential threats. One prevalent risk is phishing attacks, where users may be tricked into revealing their private keys or recovery phrases through malicious sites or deceptive emails. It's crucial to ensure that one only interacts with official resources and double-check any URLs before entering sensitive information.

Another risk stems from malware and viruses that can infiltrate devices, allowing hackers access to wallets or browser extensions. Regular device maintenance through software updates and using reputable antivirus protection can mitigate this threat. Additionally, public Wi-Fi networks pose risks, so utilizing virtual private networks (VPNs) when accessing wallets remotely is advisable.

Lastly, the misconception of safety in relying solely on custodial wallets can lead to significant vulnerabilities. While these wallets offer user-friendly access, they also present a single point of failure, where a breach could result in plummeting asset safety. Therefore, taking personal accountability for private keys and understanding the risks involved in using various wallet types ensures a more robust security posture during trading and storage.

综上所述,选择一个合适的UNI币钱包需要综合考虑安全性、易用性和自身投资策略。随着DeFi的持续发展,UNI的前景值得期待,但安全存储和管理始终不可或缺。